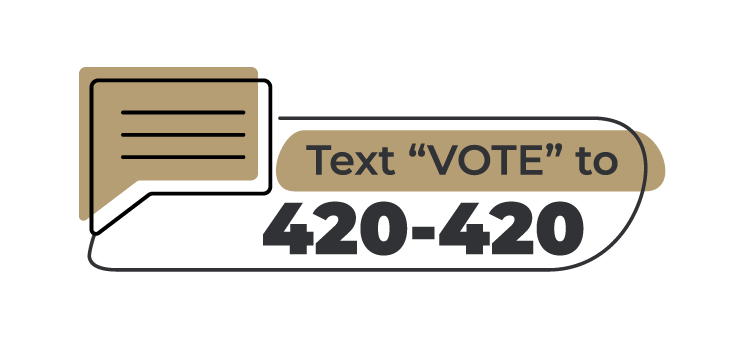

The fate of the cannabis legalization bill, House Bill 639, which passed in the New Hampshire House of Representatives, now lies in the hands of the Senate. With mixed predictions from GOP lawmakers, the Senate will discuss various reform proposals during a committee hearing scheduled on the cannabis holiday, 4/20.

The Current Status of Cannabis in New Hampshire

As of now, New Hampshire has not yet legalized recreational cannabis, making it the last state in New England to maintain its prohibition of the substance. However, the state has already taken some steps toward cannabis reform, including implementing a medical marijuana program and decriminalizing possession of small amounts of cannabis.

Medical Marijuana Program

New Hampshire’s medical marijuana program, established in 2013, allows patients with qualifying conditions to use cannabis for therapeutic purposes. Patients with a valid medical marijuana card can purchase cannabis products from one of the state’s licensed Alternative Treatment Centers (ATCs). The program is regulated by the New Hampshire Department of Health and Human Services (DHHS).

Decriminalization of Small Amounts of Cannabis

In 2017, New Hampshire decriminalized the possession of small amounts of cannabis. Under the current law, possession of up to ¾ of an ounce of cannabis is considered a civil offense, punishable by a fine of up to $100. Possession of more than ¾ of an ounce can result in a misdemeanor charge, with penalties including up to one year in jail and a fine of up to $350.

Senate President’s Opposition to Legalization

Senate President Jeb Bradley (R) has expressed his opposition to the bill and doubts its passage in the Senate. Bradley told The Conway Daily Sun, “I have supported medical marijuana and decriminalizing three-quarters of an ounce of marijuana. I am not going to vote for recreational marijuana. I think when all is said and done, it’s not going to be enacted into law.”

Advocates Remain Hopeful

Despite Bradley’s stance, some senators and advocates remain optimistic about the bill’s chances, given the momentum from the bipartisan House leaders and changes in membership after last year’s election. Senator Keith Murphy (R), a co-sponsor of the bill, believes the chances of the bill passing this session are 50-50. Murphy said, “Prohibition has proven over and over to be a failed public policy. It is especially ineffective when all of our surrounding states have already legalized marijuana possession and use.”

Pete Mulvey, an aide to Senator Murphy, told The Boston Globe that the issue is “still up in the air,” and the chances of passage are “likely as good as they have ever been.”

Upcoming Judiciary Committee Meeting

The Senate dynamics surrounding cannabis legalization will become clearer on April 20, when the Judiciary Committee is scheduled to consider several cannabis bills, including the main House-passed legalization measure. The panel will also discuss separate legalization legislation, proposals to allow medical cannabis patients to grow their own plants, expansion of the medical marijuana program, and lowering criminal penalties for drug-related offenses.

Optimism for Legislation Passage

Representative Michael Costable (R) expressed optimism about the bill’s chances this time around, stating that although the Senate has been a “disappointment” in past sessions, he believes “this time is different, and the Senate will pass this on to the governor.” Costable added, “I do believe pressure on the Senate and governor from constituents could help nudge them into accepting this excellent legalization bill.”

House Bill 639, sponsored by Majority Leader Jason Osborne (R) and Minority Leader Matthew Wilhelm (D), passed the House with more than two-thirds of the vote. If enacted, adults 21 and older would be able to purchase, possess, and give up to four ounces of cannabis, and the newly renamed Liquor and Cannabis Commission would be responsible for regulating the marijuana market and issuing business licenses. The bill proposes a 12.5% tax on cannabis products at the wholesale level, with the revenue distributed among various state programs and services.